Home »

Forensic Economics Blog

American Workers: Where Are You?

The Wall Street Journal reported how a restaurant owner resorted to offering employees a $1,000 bonus for staying on for three consecutive months. The Business Insider reported how a McDonald’s restaurant, which pays a few dollars an hour higher than the local minimum wage, was offering people $50 just to show up for a job interview. He failed to attract many applicants.

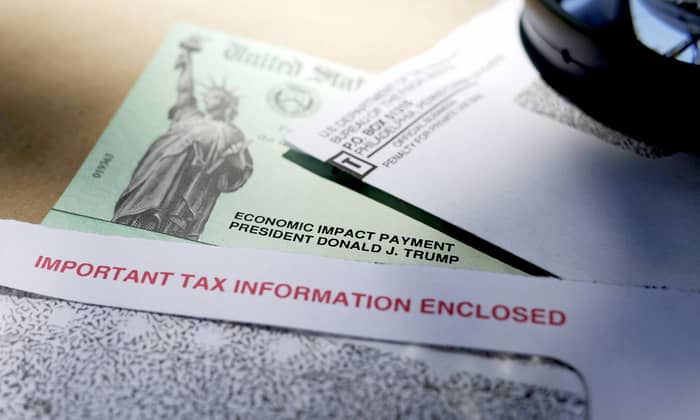

The REAL Price of the Economic Stimulus

The sheer magnitude of recent federal efforts to stimulate the American economy over the past year is difficult to fathom, but the potential for their unwanted side effects is easier to grasp.

President Trump signed the CARES Act in March of 2020, adding $1.9 trillion of COVID-related assistance to the existing federal budget. He also signed the Consolidated Appropriations Act in January of 2021, adding another $900 billion in aid. When President Biden recently signed the American Rescue Plan in March of 2021, he added $1.9 trillion more in assistance.

The New Remote Workforce

As remote work becomes the new normal, employees are relocating their residences beyond the suburbs of metropolitan business centers—even to an entirely different state. Often, they are making lemonade from the lemons of the Covid crisis, seeking to fulfill personal goals or accommodate the needs of family members. They are pursuing a happier work-life balance that retains their salary and (most) of their company benefits. But is this effort sustainable?

Seattle Exodus

Big City, Small Dreams

When the economic environment of a major metropolitan city changes, its residents will respond—with their feet. Higher apartment rents and worsening crime rates can chase away residents. Higher taxes and more burdensome regulations can chase away jobs.

The transfer of Oracle headquarters from San Francisco, CA to Austin, TX is but one example. The pending move of Hewlett-Packard from Palo Alto, CA to a suburb of Houston, TX is another. And don’t forget Tesla is relocating factories from Fremont, CA to Austin, TX.

An In-Depth Look at Minimum Wage in Seattle

One concept they teach in every university economics class is that life is full of trade-offs: every decision you make will have both positive and negative consequences—otherwise, there wouldn’t actually be a decision that needs making. Put another way, there is no such thing as a free lunch.

International Trade and the 2020 Elections: What to Expect from a Biden Administration

International trade allows each economy to consume a larger and broader market basket of goods than if they each tried to go it alone. When each country exports their surpluses of specialized goods to import the goods that they lack, the lives of consumers in both countries are much improved.

However, this also means some domestic industries gain jobs while others lose them. The American economy has parlayed its own advantage at exporting tech-related goods and services into a growing number of domestic, white-collar jobs. Yet, importing ever more manufactured goods from overseas has resulted in the “export” of millions of American blue-collar jobs abroad.

The Revamp (or rehab) of Black Friday

The Covid-19 pandemic has been harsh on the American retail economy. Like the lingering symptoms of an illness, the year’s economic shutdown will influence both consumers and businesses during the coming Holiday shopping season.

Trading Economics reports that total retail sales were hardest hit in April, when they were 20% lower than last April. The U.S. Bureau of Labor Statistics estimates that over 2.5 million retail jobs were lost during the second quarter alone—about 16% of the American retail workforce.

Why Are Fewer Americans Wanting to Retire?

The average age of retirement for American workers has been inching upwards over the last two decades as fewer people retire at the traditional age of 65. Data from the Bureau of Labor Statistics indicate that in the year 2000, only a quarter of all Americans aged 65 or older were working. Today, over one-third of those 65 or older are still in the labor force.

The Winds of Change are (maybe) a Blowin’

Next month’s Presidential election promises to be a polarizing event. The political right sees candidate Biden as a progressive socialist promoting social and economic policies that are harmful to economic growth. The left sees the incumbent Trump as an unprincipled crony-capitalist who is ignoring deteriorating social justice issues. Both sides are anxious about the implications of Biden’s proposed policies on the American economy and its social fabric. It is worth taking a quick look at the expected economic impacts of an aspirational Biden administration on American pocketbooks.

The Economic Virulence of COVID Weighs Heavily on both Women and the Young

This economic body blow far surpasses the impact of the 2010 Great Recession

Brought about by the global financial crisis, the Great Recession pales in comparison. The Federal Reserve Bank noted that U.S. GDP shrank 4.3% from its peak in 2007 to its trough at the end of 2009. American unemployment during that time peaked at just under 11%.

Truth Be Told: We Still Know that We Do Not Know

Truth Be Told: We Still Know that We Do Not Know

Earlier this month, economists’ forecasts had called for a decline of 7.5 million in payrolls and a jump in the unemployment rate to 19%. No one in Bloomberg’s survey had projected improvement in either figure”.

Read article here

While the announcement is now focusing on the fact the Department of Labor has stated the identified unemployment rate drop for May from 14.7% to 13.3% is incorrect because of the difficulty in garnering true data during the pandemic, little is discussed about how the experts, whose sole job it is to predict the economy’s progress, could have been even more wrong than the numbers outlined by the DOL.

Case Highlights: Incarceration and Past Earnings Loss

Given the fact that over 650,000 inmates are released back into our community each year and this number grows with the population growth, my involvement with claims involving individuals with previous prison time is becoming more frequent.

I recently was involved in a case concerning a male who was injured during his time of incarceration between the ages of 29 to 36. The claim from the plaintiff was his inability to participate in the labor force due to his injuries sustained while in prison. My counterpart projected the active remaining work years, had the accident never occurred, to age 65 upon his release from prison. My counterpart represented his post-incarceration earnings capacity would have been represented by entry-level trade work at an earnings level of $45,000 annually. The sum of these assumptions (if you were to believe to be accurate) would present a future earnings loss in the neighborhood of $1.2 million.

Wading Through Junk Science During a Global Pandemic

This is an essay written by my father, David Knowles, founder of The Knowles Group.

Teaching economics classes to MBA students required a certain style. They had just finished a day’s work downtown. The drive to the college after work may, for many, have been on their way home, and every night they had to make the decision to pull into the parking lot or to continue home to dinner and the kids. Classes were taught in rooms that were built for daytime, and my classroom boasted an entire wall of glass. While in the daytime this offered beautiful light, at night, students would shuffle in from the parking lot and see a large expanse of glassed darkness. They were there to listen to me teach economics which after a full day’s work can be quite challenging for many.

What We Know is that We Don’t Know

If you are on a sailboat for the first time in your life and the sea becomes rough, perspective is difficult to find. The boat rails under and waves are so treacherous that you are temporarily ensconced. You are cold, confused, and thoroughly frightened. Somehow, you survive. Your friend’s boat stays afloat. And you have stories to tell for years to come.

All I Really Need to Know I Learned in Economics Class

Historically, the holidays provide challenges. Friends and business acquaintances often get together and I find myself in foreign settings talking to people I barely know or do not know at all. While at a party I am asked what I do for a living; just a pleasant conversation-starter question. But the problem is, I must tell them, and once I tell them I am an economist or worse, a forensic economist, the glitter in their eyes subsides. They seek another face in the crowd, and a limp response ensues. Naturally, there are no follow-up questions for my answer.

Economic Damages: Work-life Expectancy v. Retirement Age Adding years onto the end of earnings loss calculations

Each month The Knowles Group will present a distinct economic component or inactive case highlights of a disputed variable in economic damage analysis.

Economists are tasked with determining work-life expectancy for the plaintiff in all matters concerning loss of earnings. When forensic economists are asked to forecast, we avoid speculation and reliance on plaintiff’s belief or intention. We instead lean on objective data in the form of historical indices and survey tables to help form assumptions about the future.

An interesting case example I faced recently included the assertion from my counterpart that the 60-year-old plaintiff working in the construction trades at the time of the incident would have continued to work until the age of 75 had the accident not occurred.

Welcome to Our Blog

Welcome to The Knowles Group blog! Check back often for articles about forensic economics and litigation consulting. Have a question or want to get in touch about a case? Contact me.

Peddling Present Value

Whether you realize it or not, you’re using economics almost everyday. And while you may have very few occasions (if any) where you’ve misplaced your calculator and that long division actually comes in handy, economics plays an important part of our lives. My wife and I were having a conversation about shopping at Costco, and what items are the most economically advantageous to purchase at certain times in terms of the present value of money. At the conclusion of this conversation, I decided to shed some light on the subject.